Payroll Update

Additional Bank Holiday confirmed for 2023

2023 will become the second year in a row to gain an additional bank holiday. May 8, 2023, will be a bank holiday to celebrate the coronation of King Charles III, which will be held on the Saturday 6 May 2022.

May will now see three bank holidays, as this is in addition to the Early May Bank Holiday on 1 May 2023 and the spring bank holiday on 29 May 2023.

As with last year, the CIPP recommends that contracts are inspected to identify the impact on holiday entitlements. There is no legal requirement for bank holidays to be given off as paid leave, however, wording in relevant agreements (usually a contract or employee handbook) will be very important.

Employers are urged to think about policies and procedures ahead of time and how to communicate these to workers.

—————————————————————————————————————

Bank Rate increases to 3%

In a move that marks the highest increase for 33 years, the Bank of England’s Monetary Policy Committee has increased the bank rate to 3%, an increase of 0.75%.

The committee voted on the proposed increase, seven voting in favour and two voting against it. However, the votes against would have preferred to see an increase of 0.25% of 0.5%, therefore, all were in favour of an increase in some way.

Payroll professionals must now keep an eye on HM Revenue and Customs’ (HMRC’s) late payment interest and repayment interest rates. These track the base rate as such:

- late payment interest – set at base rate plus 2.5%

- repayment interest – set at base rate minus 1%, with a lower limit of 0.5%.

The next review of the base rate is due on 15 December 2022.—————————————————————————————————————

Interactive tax code assistance tool released

Individuals receive change of tax code notices for many reasons. These reasons may not always be known by the employer, making advice and guidance difficult to offer.

These reasons can be:

- the individual starts to get income from additional job or pension

- the individual’s employer tells us they have started or stopped getting benefits from their job

- the individual gets taxable state benefits

- the individual claims marriage allowance

- the individual claims expenses they get tax relief on.

To assist individuals in accessing the correct information, based on their needs and situation, HM Revenue and Customs (HMRC) has released an interactive tool. The ‘get help understanding your tax code tool’ will help the user understand the reasons for the change and what next steps can be taken.

—————————————————————————————————————

HMRC Agent Update 102

HM Revenue and Customs (HMRC) publishes its Agent Update on a monthly basis, which is produced to advise agents of any updates they should be aware of.

This month’s update provides information in the areas of tax, making tax digital and agent forum and engagement.

Of particular note, is confirmation of changes to secondary legislation regarding advances and real time information (RTI) reporting requirements. Additionally, there’s discussion of the fact that all HMRC officers who make visits to customers regarding debt will carry card readers with them. This is to allow individuals to provide payment at the premises, rather than having to contact the helpline.

—————————————————————————————————————

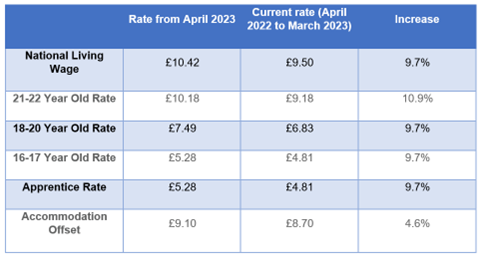

National Minimum Wage rates 2023/24

The UK government has accepted the proposals from the Low Pay Commission (LPC) on the NationalMinimum Wage (NMW) rates from April 2023.

But what are those rates? The LPC has released the rates as below:

Once again, the 21–22 year-old rate has been increased by a bigger percentage than other rates. This appears to be in preparation for the National Living Wage (NLW) to apply to all workers over 21, targeted to be implemented in April 2024.

Workers across the nation will welcome this announcement, however, employers will need to carefully plan for the impacts of increased staffing costs.

—————————————————————————————————————

2023/24 statutory payments released in benefits and pensions document

One of the big announcements from the Autumn Statement was that the pensions triple lock will be honoured. Meaning that state pension rates will rise with the September figure for inflation, 10.1%.

The Department for Work and Pensions (DWP) has released the benefits and pension rate document detailing the rates currently known for 2022/23 and 2023/24. This confirms state pension at £203.85 for 2023/24.

Also included in the document are the statutory payment amounts for next tax year.

Statutory maternity, paternity, adoption, shared parental and parental bereavement pay will all be set at £172.48 per week and statutory sick pay will be set at £109.40 per week.

The document has details on a raft of other benefits and allowances.—————————————————————————————————————

LPC minimum wage rates 2023 full report

We received confirmation that the government would accept, in full, the Low Pay Commission’s (LPC’s) national living wage and minimum wage recommendations in the Autumn Statement. This sees the national living wage (NLW) reach £10.42 per hour, a 9.7% increase.

The chair of the LPC, Bryan Sanderson, signed the recommendation letter and includes some background to decisions. On the NLW it was notes the need for balance, Sanderson said:

“Both employers and workers are worried about rising costs. For workers, an NLW rise normally guarantees their pay rises faster than prices, protecting their living standards. In the current context this is more important than ever. But for employers, rising wages are another bill alongside their energy, raw materials and other costs that can threaten jobs or may need to be passed on through higher prices.”

The full report is also available and goes into much more detail regarding the feedback received from stakeholders. The CIPP are proud to have held roundtable events with the LPC to allow our members to give qualitative feedback directly to commissioners. If you are interested, please keep an eye out for future roundtable invites which will be sent to full, fellow and chartered members.

The LPC’s remit is to achieve a NLW of two-thirds of median income to those aged 21 and over by 2024. The current recommendation of £10.42 is estimated to be 63.9% of median hourly pay, getting close to the target figure. Due to uncertainty over future wages the estimate for the 2024 rate currently spans from £10.82 to £11.53.

—————————————————————————————————————

TPR seeks views on dashboards compliance and enforcement

Pensions dashboards are fast approaching, with the first schemes’ due to go live in August 2023. In preparation for this, The Pensions Regulator (TPR) is asking for feedback on its compliance and enforcement policy.

The consultation, which closes on 24 February 2023, sets out scenarios on how TPR’s approach may be put into practice. TPR invites any and all comments on the scenarios and draft policy but has also provided some specific question to probe into areas of interest.

New legislation has been passed which will enable TPR to issue third parties with compliance notices, for which non-compliance could be fined up to £50,000 for each breach.

The final policy will be expected in Spring 2023, allowing ample time for the first schemes to be familiar with the compliance processes in place.—————————————————————————————————————

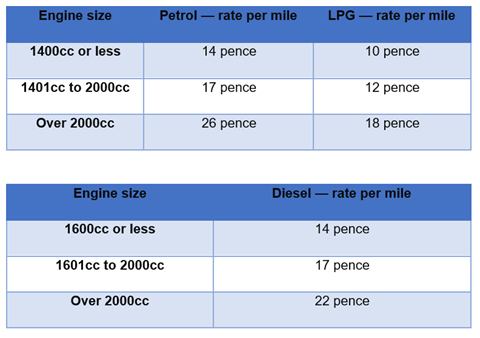

Advisory Fuel rates from 1 December 2022

HM Revenue and Customs (HMRC) has released the advisory fuel rates to be used from 1 December 2022. You can use the previous rates for up to one month after the new rates apply.

The fully electric car advisory rate will rise from 5 pence per mile to 8 pence. This will also now be reviewed quarterly along with the other advisory fuel rates.

Hybrid cars should be treated as petrol or diesel for the purposes of these rates.